One of the most effective ways to provide some or all of your required level of income in retirement may be via a regular retirement income stream such as an account-based pension or an annuity. Some retirees may also be eligible for an Age Pension or other benefits from the Australian Government. It’s important to understand how all these options work, to determine the solution that is right for you.

Will I have enough to retire?

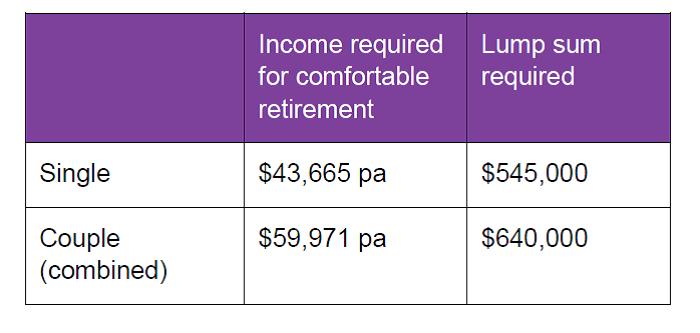

With improved life expectancy and advances in medical science, Australians can look forward to a much longer and more active retirement than past generations. A male retiring at age 65 will likely spend around 19 years in retirement and a female 22 years.1 Enjoying a long and happy retirement, however, may cost more than you think. According to the Association of Superannuation Funds of Australia (ASFA), the following lump sums are required to provide a comfortable level of retirement income for 25 years of retirement.2

Your financial adviser can help you see how you are tracking by determining your future income potential, projecting your final savings at retirement, and taking you through your options.

Transition to retirement – flexibility and choice

Before you retire you have the option to ‘transition to retirement’ (TTR). This means you can reduce your work hours and supplement your income with potentially tax-effective withdrawals from your super through a transition to retirement income stream. Your financial adviser can help outline your choices and the impact that starting a transition to retirement income stream may have for your super balance at retirement.

Earnings on assets supporting a transition to retirement income stream are generally taxed at up to 15%. Prior to 1 July 2017, they were tax free.

How do I access an income in retirement?

As well as any Age Pension you’re entitled to, or non-super investments such as properties that you will retain and receive income from (e.g. rent), the most common way to provide for your required level of retirement income is with one or more regular retirement income streams. These include:

-

Account-based (allocated) pensions – these must be purchased with your super savings

-

Lifetime or term annuities – these can be purchased with either your super or non-super savings

In some cases, the best way to provide for your retirement income could be to combine an account-based pension and an annuity.

What are account-based pensions and annuities?

An account-based (or allocated) pension lets you draw regular flexible pension payments from your super balance. Your pension account balance is adjusted in line with market movements, investment returns, pension payments, lump sum withdrawals and fees.

An annuity generally involves swapping some of your retirement savings for a guaranteed income stream payable over a specified period. The two main types of annuities are:

-

Fixed term annuities which pay a guaranteed income for a defined period of time eg 20 years

-

Lifetime annuities which pay a guaranteed income for the remainder of your life.

By guaranteeing your future income payments regardless of the underlying performance, the annuity provider effectively carries all the investment risk. They also offer flexible ownership options and indexing to protect against inflation. The trade‑off for an investor is you generally have no choice of investments, limited ability to make withdrawals and can’t change your income once the annuity has commenced.

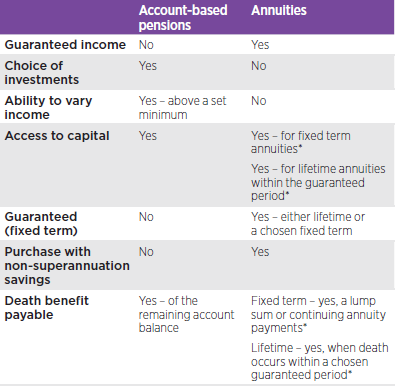

A summary of the key features of account-based pension and annuities is as follows:

*Withdrawal value may be less than the amount invested, even after taking into account payments you have already received.

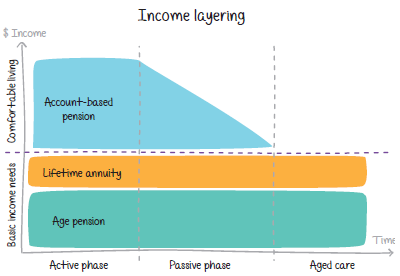

Combining retirement income streams

The right mix of retirement income streams will depend on your individual needs and circumstances, which might include:

- Your fixed and variable income needs in retirement

-

Whether you will need to access some of your retirement savings as a lump sum in the future

-

How important qualifying for social security benefits such as the Age Pension is to you

-

Your estate planning needs, including whether you want to leave an inheritance to your dependants in the future

-

Your tolerance for risk when investing

For example, you could consider using a lifetime annuity to provide enough guaranteed income (along with any Age Pension you’re entitled to) to allow you to meet your fixed income needs in retirement, while using flexible payments from an account-based pension to meet your additional non-essential spending needs – as shown in the following graph.

Your financial adviser can help you decide the mix of income streams that best suits your circumstances.

How are account-based pension and annuities taxed?3

If you commence an account-based pension or annuity with super savings, earnings on assets supporting the income stream are tax free, compared to the accumulation phase of super where earnings are taxed at up to 15%. The taxation of payments you receive from the pension or annuity is as follows:

-

Aged between preservation age and 59 – income received is assessable and taxed at your marginal tax rate. Part of each payment may be tax-free and you may qualify for a 15% tax offset on the taxable component which means you may end up paying little or no tax on your income. Lump sum withdrawals (where possible) may also be taxed, part of the withdrawal may be tax-free and the remainder taxed at a maximum rate of 15% plus the Medicare levy.

-

Aged 60 or above – any income and lump sum withdrawals received are tax-free.

Income payments from annuities purchased with non-super savings are assessable and taxed at your marginal tax rate. However, part of your payment, generally equal to the return of your original investment over time, will be tax-free.

If you receive income from one or more ‘capped defined benefit income streams’, additional tax will apply to part of any payments you receive over $100,000 during a financial year. Capped defined benefit income streams include:

- certain lifetime pensions commenced at any time, and

- certain lifetime annuities, term pensions and annuities, and term allocated pensions, commenced at any time.

Transfer balance cap

A 'transfer balance cap' applies to limit the total amount of superannuation savings you can use to commence retirement phase income streams. Extra tax may apply if you exceed the cap, and you will generally have to move the excess back to the accumulation phase of super or withdraw it from the super system.

The general transfer balance cap is $1.6 million, although indexation may apply in future years.

Retirement phase income streams include account based pensions, and most other superannuation income streams, but generally not transition to retirement income streams. The value of a transition to retirement income stream will only count toward the $1.6 million transfer balance cap if you are age 65 or over or you have notified the fund that you have retired, are permanently incapacitated or terminally ill.

Amounts that count against the transfer balance cap generally include the existing value of retirement income streams at 30 June 2017 (for example the current balance of an account based pension) and the starting value of any new retirement phase income streams (including death benefit income streams) commenced on or after 1 July 2017.

The amount that counts against this cap is reduced by:

• lump sums withdrawn from retirement phase income streams from 1 July 2017

• amounts rolled over from retirement income streams from 1 July 2017

• the value of structured settlement superannuation contributions made by you

• 'replenishment debits' applied where the value of your retirement income stream has been impacted by fraud or dishonesty, bankruptcy or a family law payment split.

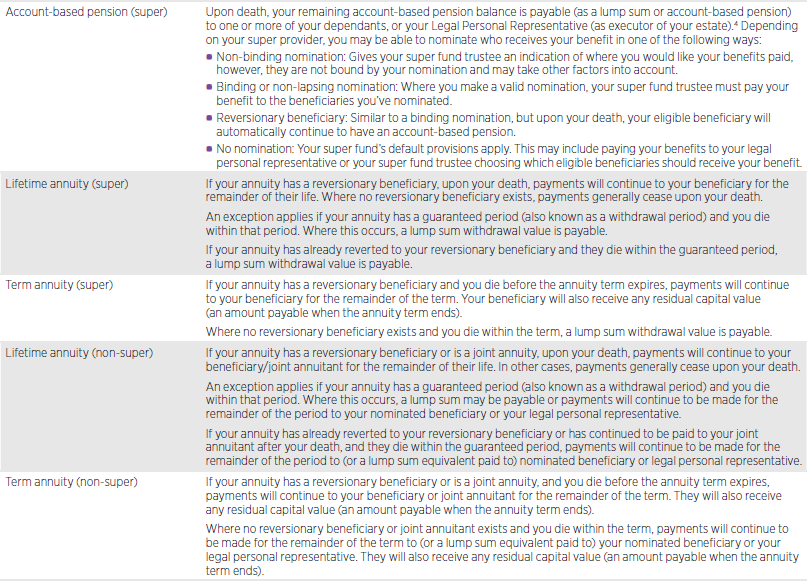

What happens to your account-based pension or annuity when you die?

The treatment of your retirement income stream upon your death depends on:

-

The type of income stream.

-

Whether your income stream was purchased with super or non-super savings.

-

The type of beneficiary arrangements you have in place (if any).

-

The beneficiary's remaining transfer balance cap.

Social security benefits

The Government provides a range of social security benefits to assist certain individuals and families. The type and amount of benefits you can receive depend on your personal and financial circumstances and your stage of life. Common benefits that retirees may be entitled to include the Age Pension, Service Pension, Pensioner Concession Card, and Commonwealth Seniors Health Card.

What are the Age Pension and Service Pension?

The Age Pension (managed by the Department of Human Services) is a social security benefit designed to ensure that all eligible Australian retirees have at least a basic level of income in retirement. The Service Pension (managed by the Department of Veterans’ Affairs) provides the same type of support to eligible veterans and their partners, widows or widowers.

The Age Pension and Service Pension are generally paid at the same rates and normally subject to the same income and assets tests.

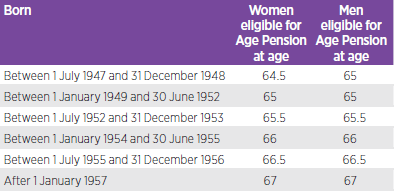

Age requirements

To qualify for the Age Pension or Service Pension, you must have reached age pension age. This age depends on when you were born and is shown in the following table.

The age pension age for Veterans with eligible qualifying service is 5 years younger than the normal age pension age – for example, the age pension age for an eligible female Veteran born on 1 January 1954 would be 61.

In the Federal Budget released in May 2014, the Government proposed increasing the age pension age to 70 by the year 2035. At the time of writing, this proposal had not been legislated.

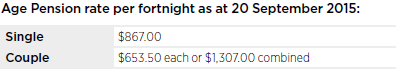

Payment rates

The maximum Age Pension and Service Pension rates are as follows.

Rates include maximum pension supplement and energy supplement. Maximum rates are indexed every 6 months on 20 March and 20 September. For the latest rates refer to www.humanservices.gov.au or www.dva.gov.au.

However, the Age Pension and Service Pension are subject to means testing, which means your actual rate of payment may be reduced because of your financial situation. Means testing includes calculating your payment under both an assets test and an income test- the one that results in the lowest payment rate will then apply.

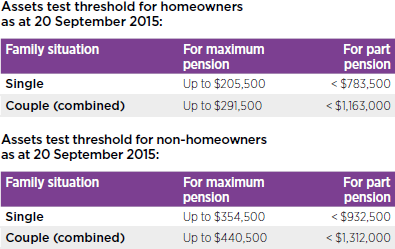

Understanding the assets test

For the purposes of the assets test, an asset is any property or possession that you fully or partly own. Assets are valued according to their net market (sale) value.

Some of the assessable assets covered by the test are:

-

funds in bank accounts, shares and managed funds

-

superannuation funds (once over Age Pension age)

-

motor vehicles, boats and caravans

-

household contents and personal effects

-

property such as holiday homes

-

retirement income streams such as account-based pension and annuities.

Some assets are exempt from the assets test, including:

-

your principal home

-

superannuation (while under age pension age)

-

certain retirement income streams purchased before 20 September 2007 (may be 50% or 100% exempt) – seek financial advice if you think you already have one of these income streams.

-

pensions from a defined benefit superannuation scheme.

Under the assets test, your pension will not reduce until your assets exceed a lower threshold. For every $1,000 of assets you have above the lower threshold, your pension will then reduce by $1.50 per fortnight (singles or couples combined) until it cuts out completely. The assets test thresholds differ depending on whether you are single or married and whether or not you own your home, and are shown in the following table.

Lower thresholds are indexed each year on 1 July, while upper thresholds may change on a quarterly basis. There are also different rates for a couple separated by illness and a couple where only one partner is eligible for the Age Pension. Visit www.humanservices.gov.au or www.dva.gov.au for full details.

Assets test treatment of account-based pensions and annuities

The account balance of your account-based pension is counted for assets test purposes.

If you purchase an annuity, the purchase price initially counts for assets test purposes. However, this value may then be reduced over time to take into account the proportion of each annuity payment that represents repayments from your original capital.

Upcoming assets test changes

The assets test for pensions will change from 1 January 2017. The “taper rates” where for every additional $1,000 in assets above the minimum threshold for a full pension, fortnightly payments reduce will increase to $3 from the current $1.50. This change will effectively lower the upper asset threshold where the pension ceases to be payable.

The minimum threshold for the maximum pension will also increase from 1 January 2017.

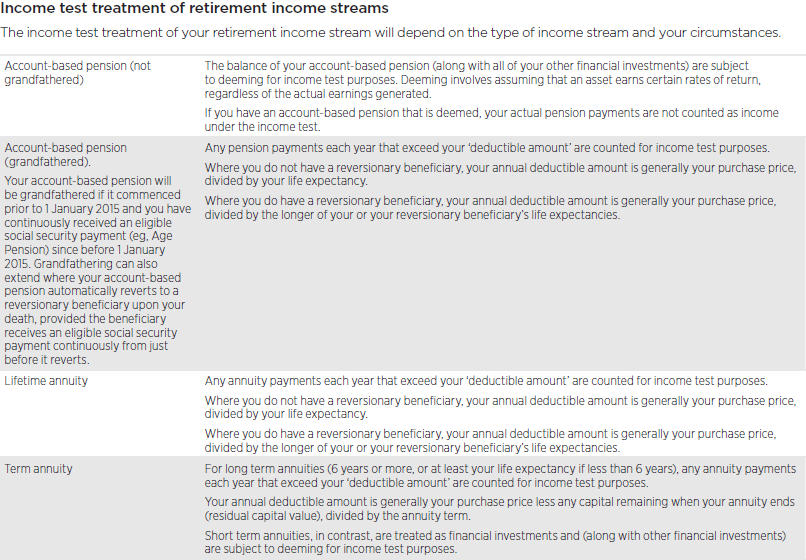

Understanding the income test

For the purpose of the income test, income is defined as any money earned, derived or received for your use or benefit and includes:

-

deemed income from financial investments such as shares, managed funds and bank accounts

-

deemed income from superannuation where you have reached age pension age

-

gross income from salary and wages

-

income from business and real estate

-

certain levels of income from retirement income streams such as account-based pensions and annuities

Under the income test, your pension will not reduce until your income exceeds a lower threshold. For every dollar you have above the lower threshold, your pension will then generally reduce by 50 cents per fortnight (singles or couples combined) until it cuts out completely. The thresholds are shown in the following table.

.png)

Lower thresholds are indexed each year on 1 July, while upper thresholds may change on a quarterly basis. Visit www.humanservices.gov.au or www.dva.gov.au for the latest thresholds.

Take advantage of the Work Bonus

The Work Bonus provides an incentive to keep working once you reach age pension age. Under this concession, the first $250 of employment income you earn per fortnight is not counted under the income test. Depending on your situation, this can mean up to an extra $3,250 pa in age pension (single or couple combined).

Pensioner Concession Card

If you receive an eligible income support payment (for example the Age Pension or Service Pension), you also get a Pensioner Concession Card. Cardholders are eligible for reduced cost medicines under the Pharmaceutical Benefits Scheme (PBS), as well as other concessions, including reduced water rates, energy bills and property rates, a telephone allowance, reduced public transport fares and reduced motor vehicle registration costs.

Commonwealth Seniors Health Card

Even if you don’t qualify for the Age Pension (for example, your assets or income are too high), you may be eligible to receive the Commonwealth Seniors Health Card (CSHC). The CSHC provides a range of benefits, such as discounts on prescription medicine, Australian government funded medical services and other government concessions, to certain self-funded retirees.

To qualify for the Commonwealth Seniors Health Card, your adjusted taxable income must be less than $52,273 pa (singles) or $83,636 pa (couples combined). It’s also important to note that under recent changes, a deemed amount of income from your account-based pension will count towards this income test. However, if your account-based pension commenced prior to 1 January 2015 and you have continuously held a CSHC since before that time, your account-based pension income is exempt from this income test.

Why financial advice is important

-

Talking to a financial adviser before you retire will help put you on the road to financial security and access the following benefits:

-

Getting help from an adviser can help you decipher complex super and tax legislation and translate them into actionable strategies.

-

They follow a proven process to ensure all aspects of your financial well-being are covered.

-

They can help you assess the best income stream option and also structure your retirement portfolio to minimise tax.

-

They are supported by a network of technical and qualified specialists in super and retirement.

-

You can schedule regular reviews to ensure you stay on track before and after you retire so all

you need to focus on is enjoying a new more relaxed lifestyle.

1 Australian Government Actuary, Life tables, 2010–12.

2 ASFA Retirement Standard – June 2015. All figures in today’s dollars (using 3.75% as a deflator) and assumed investment return of 7% per annum. Assumes retirement age of 67 and retirement duration of 25 years. Figures based on the means test for the Age Pension in effect from 1 January 2017.

3 This tax treatment applies to payments from taxed super funds. Additional tax may apply so payments made from untaxed Government super funds.

4 Dependants include your spouse, child, financial dependant or interdependent relation. Death benefits can only be paid as a lump sum if paid to your legal personal representative or child (unless aged under 18, under 25 and financially dependent on you or permanently disabled).

The information on the Website is or a general nature only and has been prepared without taking into account your, or any other investor's, particular financial needs, circumstances and objectives. The information on this website should not be construed as financial, taxation or legal advice. Hastings Financial recommends that you consult a financial adviser for advice that addresses your specific needs and situation before making investment decisions.