When deciding which investments are right for you, it is important to understand the trade-off between risk and return and how to manage investment risk. A risk profile can help identify the type and mix of investments that will best help you achieve your financial and lifestyle goals.

Snapshot

-

Understanding risk will help you make the right investment decisions to suit your situation.

-

Getting to know your tolerance for risk can help reduce anxiety when investing, especially for first timers.

-

Your financial adviser can help you complete a risk profile and advise on the best investment strategy for your needs to help you reach your goals faster.

What is risk?

Investors face many different kinds of risk. One of the most common is the variability of returns. If returns don’t meet expectations, investors may not be able to meet their goals or fund their ideal lifestyle.

All investments carry some risk due to factors such as inflation, taxation, an economic downturn or a drop in a particular market. Even if you choose an investment traditionally considered ‘safe’, such as cash, there is still a risk of inflation eroding the value of your capital or falling interest rates reducing the level of your return. For more information about the different types of risk investors face, see the table overleaf.

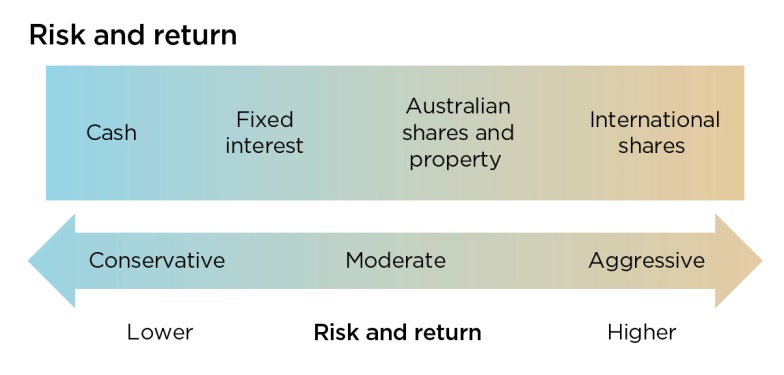

Understanding risk vs return

The level of risk an investor takes relative to the investment return they expect to receive is sometimes known as the risk to return ratio. As a general rule, the larger the potential investment return, the higher the investment risk and the longer you need to remain invested to reduce that risk.

Risk and return

Managing investment risk

The amount of risk involved with an investment can be managed by matching it appropriately with the length of time you have available to invest and your tolerance towards fluctuations in returns.

For example, if you are saving for a house deposit and have only 12 months to go before you reach your goal, you would probably be unwilling to risk losing any of that money. If so, it would make sense to avoid growth investments and consider defensive investments like cash accounts or term deposits instead.

However, if you’re investing your superannuation and you’re not retiring for 15 years, you could ride out any short term losses in growth markets to achieve potentially higher returns over time.

Calculating your tolerance for investment risk

When selecting your investments, along with considering your investment time frame it’s also important to reflect on your personal tolerance level for investment risk. You need to make sure you feel comfortable with the amount of risk you’re taking on and the potential consequences of your investment decisions.

Some people can remain relaxed while their account balance fluctuates, while others become nervous if their account shows even a small drop in value. If you’re going to lie awake at night worrying about your investments, no matter what returns you earn, they’re not likely to be worth the personal cost.

Several factors will affect your tolerance for investment risk:

-

your reasons for investing

-

your performance expectations

-

how long you intend to invest (investment time frame)

-

your knowledge of investment markets and past experiences

-

how you feel about sudden increases and decreases in the value of your investments.

Keep in mind that your tolerance for investment risk may change as you gain investing experience and confidence. If you feel that the investments in your portfolio don’t match your risk tolerance or financial goals, it’s important to talk to your financial adviser. They can help rebalance your portfolio to suit your appetite for risk, investment time frame and current financial situation.

Investment risks

It is important to understand the different kinds of risk that may affect your investments. The table below summarises some of the common types of risk.

Types of risks

|

Market risk |

The possibility that market movements could cause the value of your investment to fall in value. |

|

Investment risk |

The risk that the investment(s) you have selected do not deliver the expected returns. This may impact your ability to achieve your financial goals within the required time frame. |

|

Regulatory risk |

The risk that changes in rules, legislation or government policy could have an impact on your financial strategy. |

|

Inflation risk |

The possibility that your investment delivers returns below the inflation rate, which would erode the purchasing power of your money over time. |

|

Interest rate risk |

The risk that an increase or decrease in interest rates could adversely affect your investments. |

|

Liquidity risk |

The risk that you are unable to readily access your funds because they are invested in illiquid (difficult to sell quickly) assets. |

|

Credit risk |

The risk that a borrower may default on their repayments. |

|

Timing risk |

The risk that the time you choose to enter or exit the market may not deliver the best results for your investment goals. |

|

Concentration risk |

The risk that if you have placed all your investment capital into one asset class. |

|

Currency risk |

The possibility that investments held in other countries may rise or fall in value due to changes in the value of international or domestic currency. |

Ways your adviser can help

-

Your financial adviser provides professional financial advice for your super and investments.

-

They have the knowledge and experience to match your risk profile with your investment strategy to help deliver the returns you need and make the process of investing easier.

-

They keep track of the latest changes in laws and regulations on tax and super to save you time and help optimise your returns. Your financial adviser can also review your situation and make recommendations as your circumstances and appetite for risk change.

The information on the Website is or a general nature only and has been prepared without taking into account your, or any other investor's, particular financial needs, circumstances and objectives. The information on this website should not be construed as financial, taxation or legal advice. Hastings Financial recommends that you consult a financial adviser for advice that addresses your specific needs and situation before making investment decisions.